Sorare - the different football fantasy game

Before we start, it’s worth saying that I’m neither an expert in crypto or gaming nor did I talk to anyone from the company. I researched all of that and it’s possible I misunderstood something. If you have feedback — feel free to reach out any time here or on Twitter.

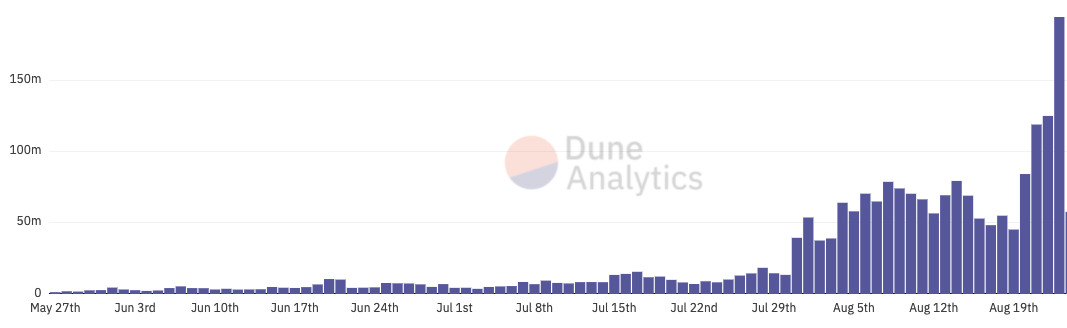

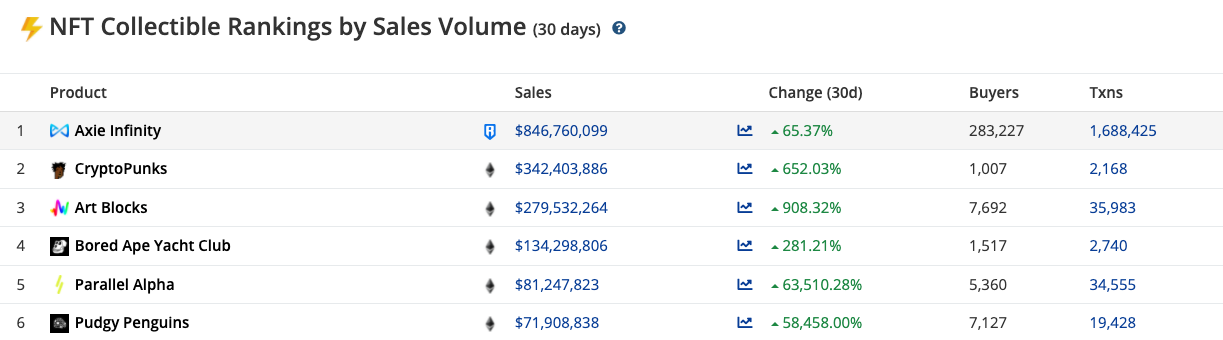

Last week, OpenSea, one of the leading marketplaces for non-fungible tokens (NFT), announced that it has hit $1 billion in trading volume in August 2021 so far. It's another milestone for OpenSea in a year that has seen trading volume up by more than 12,000% and user base by more than 7,200%.

Open Sea is a prime example of growth that has gained momentum in 2021 as NFTs and gaming became the next wave of blockchain apps that broke out. In the past 30 days, there has been over $2 billion in NFT sales.

This trend has also spread to sports, most notably when NBA Topshot made major headlines at the beginning of the year. It made early adaptors a fortune and also professional athletes started to benefit by creating their own NFTs. However, while the collection of cards is exciting for many fans, the usability of most NFTs is very limited. In fact, there’s actually not much you can do with them.

Sorare is different compared to many other NFTs projects. The Paris-based company has created a new experience for football fans by combining collectibles with a fantasy game. As opposed to NBA Topshot, for example, there is a clear utility of Sorare’s cards as they allow users to compete in tournaments and earn rewards in the form of new cards or ETH. This is crucial as it fosters both user engagement and retention.

Sorare joins the wave of rapidly growing companies in the NFT space seamlessly. In February this year, the company announced a $50 million Series A led by Benchmark with participation from Accel Partners and a variety of professional athletes and investors including Antoine Griezman, Rio Ferdinand, Oliver Bierhoff, Alexis Ohanian, and Gary Vaynerchuck. Rumors about another $532 million in funding led by Softbank have been declined by the company. It would be the largest financing round in crypto history and value Sorare at $3.8 billion.

Even though these rumors have been declined, they indicate the extent of Sorare’s growth in recent months. This development is even more impressive when considering that Sorare did hardly spend anything on marketing, not optimizing for short-term growth. Instead, Sorare describes its short-term ambition as building the best fantasy football game that exists. In the long term, it envisions a large ecosystem of experiences for Sorare card owners.

To understand the underlying mechanisms of Sorare’s growth until today and how it wants to build an entire ecosystem, we have to study three core pillars: the community, licensing deals with clubs, and the Ethereum blockchain. Before we dive into these pillars, it’s helpful to understand the origins of Sorare and how the game is played …

The origins of Sorare

Gameplay

Licensing deal with football clubs

Leveraging the community

Ethereum blockchain

Where’s Sorare now?

What’s next?

Final remarks

The origins of Sorare

Sorare was founded in 2018 by Nicolas Julia and Adrien Montfort. The two Frenchmen met each other while working at Stratumn, a platform for developing enterprise-level blockchain applications.

Like many other games, the idea of Sorare was inspired by Cryptokitties, the first project to take NFTs to the mainstream in late 2017. The game allows users to collect and breed digital cats. What made Cryptokitties so exciting was not really the game per se but its underlying technology. It was built on the Ethereum blockchain which enables the creation of scarce and portable digital items.

As huge football fans, knowing about the popularity of collecting cards of football players in the physical world, Nicolas and Adrien saw the potential of this technology to collect things in the digital world. People have been collecting things for decades in the physical world, so why not in the digital world? And football? It’s the biggest sport in the world with more than three billion passionate fans worldwide.

While this alone could have been a promising idea, the two co-founders added another layer on top of the collectible: a football fantasy game. The football fantasy game brings utility to the collectibles, ensuring that users are engaged on a regular basis and retained on the platform. Boris Golden from Partech describes this combination as one of the main reasons for Partech’s investment in Sorare’s $4m seed round:

“We were especially bullish on the idea of mixing NFTs and fantasy sports to bring a sustained engagement, deep satisfaction, emotional connection, link to the "real" world and meaningful utility to users (thus giving further purpose/value to the NFT beyond being "just" a collectible).”

The two founders launched their beta version in March 2019. It turned out to be the starting point of an impressive growth story …

Gameplay

The first thing you notice when opening Sorare is that its interface is very clean with very little friction. They do a great job of abstracting the complexity that comes with crypto from the end-user. There is no mention of crypto, NFTs, or blockchain on its platform. Instead, it is clearly focused on digital trading cards to collect and play with. As Dominic Wilhelm puts it:

“In the end, one has to create an application where users benefit from the nature of a blockchain without even recognising they are “using it”. And Sorare is doing a fantastic job at that”

As a new user, it takes you less than five minutes from signing up to completing the onboarding process. The fantasy game itself also works very straightforward. You can use your collected cards to compose a team of five players and compete in different leagues. You can score points based on the real-life performances of your players on the pitch and earn rewards in the form of new cards or ETH.

If you want to improve your team, you can do so on the primary or on the secondary transfer market, both of which work via auctions. On the primary market, Sorare sells its newly minted cards to users. On the secondary market, users sell their cards to each other.

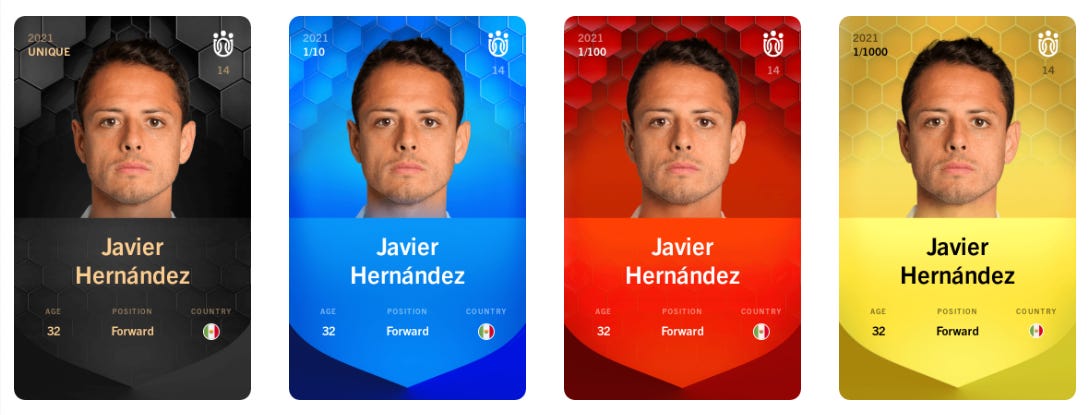

Every card falls into a scarcity category with limited supply: unique (1 card available), super rare (10), rare (100), or limited (1000). When signing up, you also receive common cards which can be used to play in lower divisions but don’t have any value.

The crucial factor with Sorare is that you own these cards as you own books and shoes you bought. In Fortnite, for example, you can spend money to get an in-game skin but you never own it – it’s only useful in the game. That’s different with Sorare thanks to the blockchain. Once you bought a player card on the market, you can decide what to do with it. You can sell it on Sorare, Open Sea, or any other platform that supports the NFT standard ERC721. This is a drastic improvement compared to other games.

The second crucial factor is Sorare’s reward system. It is one of the most important motivating factors for gamers who spend hours every day playing games like Sorare. It is not only because these gamers have fun while playing, but because they can earn rewards during the game. These rewards can be exchanged for fiat currencies instead of only being usable in-game.

This general trend of “play-to-earn”-games has become very popular among many crypto games. In his great newsletter Not Boring, Packy McCormick has analyzed one of the most popular games: Axie Infinity. It’s a great example of how this play-to-earn model can work as it has allowed a small community in the Philippines to earn an income during the pandemic. The company itself describes it as follows:

„Axie is a new type of game that rewards players for the time and effort they spend both playing the game and growing the ecosystem. […] Axie has a 100% player-owned, real money economy. Rather than selling game items or copies, the developers of the game focus on growing the player to player economy and take small fees to monetize. Axies are created by players using in-game resources (SLP & AXS) and sold to new/other players.“

If you compare Axie with Sorare, you realize that there are two big differences. First, Sorare is not 100% player-owned as Sorare mints every card itself before users can buy them. Second, Sorare does not have its own token but operates with ETH. The core principle of play-to-earn, however, remains. Players are rewarded for the time they spend playing and growing the ecosystem.

Licensing deal with football clubs

A unique component of Sorare’s business model was its ability to get official licenses from clubs around the world. They either cooperate with entire leagues or individual clubs. While they have signed more than 150 licenses today, convincing the first clubs to come on board was a tough challenge as Nicolas Julia describes:

“Why should they take a bet on you? From day 1, I think we were compelling enough in our honesty telling them we are onto something huge, building an entertainment giant and we will secure you a new revenue stream“

Other than in US sports, European football is very fragmented with various leagues. This is a double-edged sword. On the one hand, it is much more time-consuming and complex to convince hundreds of clubs individually and to negotiate with them. On the other hand, this can be advantageous in the long term, since a high degree of fragmentation means that none of the parties has particularly high market power.

Moreover, many clubs are not known to be first-mover when it comes to innovation and new technologies as Benjamin Steen, Head of Customer Care and Digital Licencing Media at Bayern Munich, admitted:

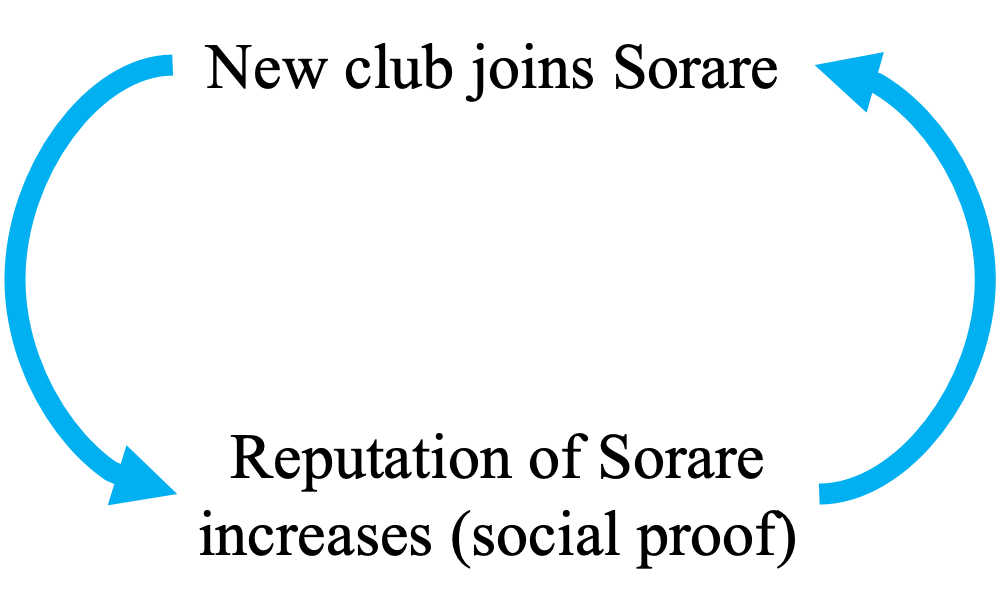

“In addition to the concept idea, we were also influenced by the fact that many high-profile clubs have already partnered with Sorare.”

There are a few things to unpack in this statement. For one, it shows some sort of general skepticism toward innovation and a general risk aversion that is present among many clubs. At the same time, it proves the psychological concept of social proof. In his book Persuasion, Robert Cialdini explains that “we determine what is correct by finding out what other people think is correct.” Charlie Munger provides another explanation when talking about the power of Coca Cola:

“The social proof phenomenon which comes right out of psychology gives huge advantages to scale — for example, with very wide distribution, which of course is hard to get. One advantage of Coca-Cola is that it’s available almost everywhere in the world.“

Applying this concept to Sorare means that it was a crucial step for the company to acquire its first customers. Once Nicolas and Adrien achieved that it made new licensing deals much easier as they could provide references of clubs who believe in the idea. Especially in the beginning, this creates a (limited) positive reinforcing feedback loop:

Nonetheless, the statement of Benjamin Steen also shows that he was generally intrigued by the concept of Sorare as were those clubs that eventually became first-movers. Sorare’s value proposition for clubs consists of three pillars, all of which are directly or indirectly supposed to lead to new revenue streams at some point.

1. New Revenue stream

Every club receives a licensing fee for allowing Sorare to use the intellectual property (IP) rights of its players. In addition, there is further revenue potential as clubs can also benefit from sales on the secondary market. More specifically, if Sorare decides to introduce a commission on the secondary market (what they currently don’t do), this additional revenue is shared with the clubs.

2. Global visibility

While national markets have arguably reached their peaks, large international markets offer further potential. Since Sorare also works with clubs in Asia and the US, it attracts people from these regions, thereby allowing big European clubs to expose their brands to potential new customers.

Regardless of the market, it also allows access to a segment of younger customers. As Gen Z doesn’t show the same enthusiasm for live sports as millennials and adults, it’s far more difficult for clubs to attract this younger fanbase. NFTs and gaming may be new ways to make up for that and get a foot in the door.

3. Fan engagement

Lastly, it’s a new way to engage with fans. This is particularly important for fans outside of the traditional markets but also with regard to younger generations as pointed out above. Gaming, in general, is already very popular but combined with blockchain technology it could become the next big wave for the gaming industry. There is a generation of gamers who have grown up playing games, spending lots of time and money on it who can now earn rewards while doing it.

This compelling value proposition is completed by the fact that there is very little effort for the clubs. They don't have to take care of anything themselves except granting IP rights. What’s more, it may also be a tiny first step for many clubs into the world of crypto and the opportunities that come along. While there are hardly any use cases today, the NBA, for example, has set up a blockchain advisory board to explore how this new technology can be used.

Leveraging the community

In his paper “A Theory of Human Motivation” (1943), the Russian American Abraham Maslow proposed “Maslow’s hierarchy of needs” consisting of five stages. The second stage of Maslow’s hierarchy is about esteem needs including a need for status, recognition, or fame which NFTs can provide. Eugene Wei has written a long article on the importance of social capital to show your status.

The third stage of human needs connects to love and belongingness. It refers to human’s need for interpersonal relationships, connectedness and being part of a group. Putting these two stages together, as much as people love to collect things, they also want to show it off and be part of a group of like-minded people.

Sorare has mastered this challenge due to its open and transparent communication. One of the first things you notice is how much they value the community and the opinions of Sorare’s users. Since its launch in 2019, Sorare has made a bet on how it will achieve its short-term goal of becoming the best fantasy game in the world – namely centered around its community and tight feedback loops.

Instead of abstracting product decisions from its users, Sorare seeks close collaboration by involving users in the design and gameplay. This makes it easier for Sorare to understand what kind of features the community wants in order to get new ideas and prioritize existing ones. This becomes very evident when reading Sorare’s blog articles. They always explain the reasoning behind their decisions. All of this leads to an iterative process removing frictions while ensuring that the game development is tailored to the users’ needs.

“A rapid iterative loop with the right customers solves for a lot of common product development pitfalls” – Michael Siliski

"“Feedback Loops — The faster the wheel is spinning, the easier it is to add incremental speed. The faster it moves, the more energy it generates. And the more excited everyone is about how great this Flywheel is!” – Eric Jorgenson

However, the second-order impact of this community-driven approach is arguably even more impactful. People want to get involved in the development process and feel like being part of something bigger. This building-in-public approach feels like giving them a seat at the table of product decisions which, in turn, leads to higher engagement. The fact that there is already a bunch of new applications, tutorials, and podcasts created by users proves the passion and excitement among them.

What’s more, a 3-month retention rate of more than 70% shows that users are not engaged for a short period of time. Brian Balfour, founder and CEO of Reforge, describes retention as “the common denominator that separates the most valuable companies from the rest of the pack.” Among other things, a boost in retention increases new user acquisition and improves monetization.

This combination of high retention and high engagement at the same time is what makes Sorare’s community so powerful. It has been one of the key drivers of growth until today. To quote Brian Balfour again:

“Retention and engagement are yin and yang. Retention without engagement tells only half the story. It doesn't matter if you have breadth (retention), if you don't have depth (engagement).”

Ethereum blockchain

Sorare is built on the Ethereum blockchain. Due to the Ethereum blockchain, Sorare cards have “superpowers” as the company itself describes it — namely digital scarcity, true ownership, authenticity, and interoperability. Interoperability is the most important superpower as it means that data is portable and provides the foundation for third-party applications. Put simply, it means that multiple applications can access and use the same information.

Ubisoft, for example, has founded the “One-Shot-League” centered around Sorare cards and Belgium’s Jupiler Pro League. It’s free-to-play, so you can easily sign up with your Sorare account and use your cards to compete in tournaments. Other examples include SorareData, Sorare Season Planner, SorarePodcast, or just last week the Sorare Academy tournament with Fantasy Football Scout.

However, with rapid growth inevitably comes new problems and new challenges. Sorare has noticed this especially with regard to its technology. After Sorare launched on the Loom Plasmachain, they migrated to the Ethereum Mainnet (layer 1) in April 2020 in order to benefit from Ethereum’s huge ecosystem, hence more exposure to the public.

Over time, however, the number of trades increased drastically from 3,000 in Q4 2019 to around 210,000 in Q2 2021. This increase resulted in two problems. First, it led to very high transaction costs due to increasing gas fees. In Q2 2021 alone, Sorare’s gas consumption made up for 1% of the total Ethereum block space. Considering the projected growth rates, this share could quickly rise to more than 10%. Second, the processing of an ever-increasing number of transactions led to delays of card transfers after purchases. This, in turn, led to multiple support tickets and questions among users.

These issues combined with Sorare’s focus on scalability have led to the decision to partner with Starkware to implement a zero knowledge (ZK) rollup. ZK rollups offload transactions from layer 1 (Ethereum Mainnet) to another layer – layer 2. In other words, layer 2 ensures that layer 1 does no longer has to work so much, which led to delays and high costs in the first place. Importantly, after the transaction is executed on layer 2, the data (e.g., player transfers) is compressed and posted on layer 1, so no security is sacrificed.

The difference between layer 1 and layer 2 when it comes to transactions processed per second is massive. While layer 1 can process around 15 transactions per second on its base layer, layer 2 can process between 2,000 and 4,000 transactions per second. Thereby, Sorare does not only solve the aforementioned problems but sets the foundation for further growth in the remainder of 2021 and 2022.

With the launch of the new player scarcity category “Limited”, Sorare is already starting to use this new scalability potential to push for a new wave of customers. By introducing this new category and new price point, Sorare is growing the total addressable market. Cards have become quite expensive in recent months and therefore, the barrier to participate has increased. Now it is possible to buy some players for less than €10 again. The new partnership with Starkware provides the basis for that as it allows for very low transaction costs that were not possible before.

Where’s Sorare now?

Network effects are one of the most powerful things for startups. Some of the largest companies today have benefitted from them – whether it’s Facebook, Airbnb, or Uber. According to Wikipedia, a network effect is present when “[…] the value of a product or service is dependent on the number of others using it.”

NYU professor Arun Sundarajan has classified network effects into five distinctive categories, one of which are two-sided network effects:

” […] increases in usage by one set of users increases the value of a complementary product to another distinct set of users, and vice versa.”

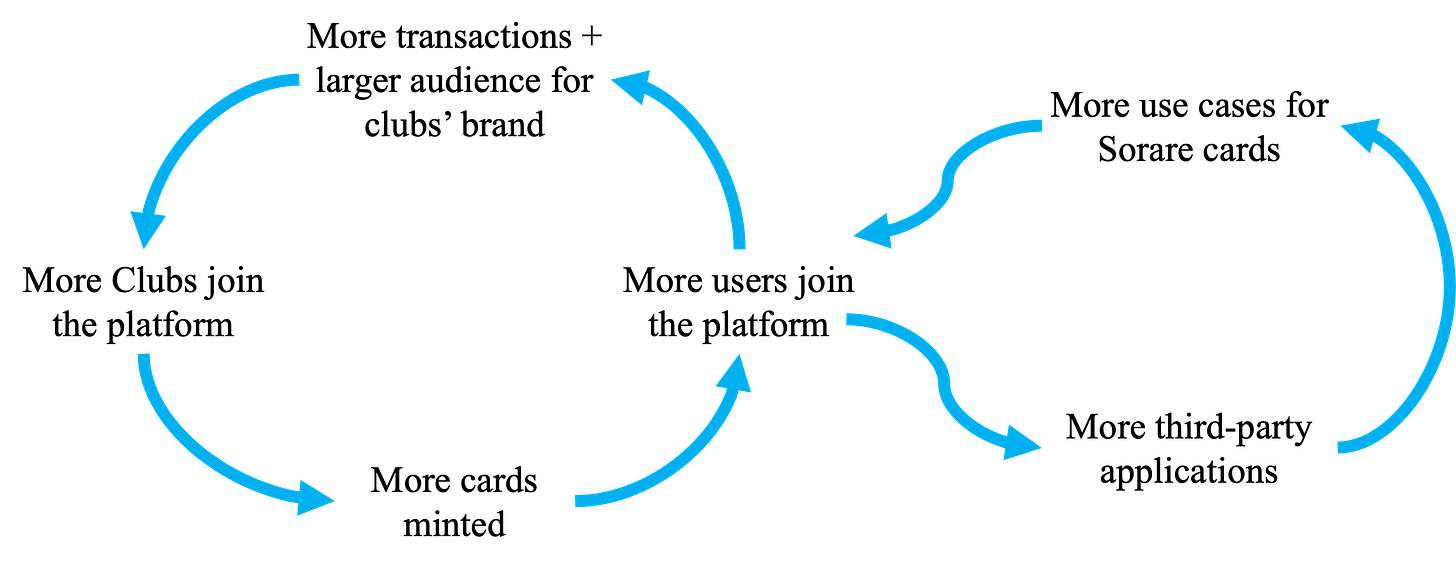

Two-sided network effects are the type that defines Sorare. On the one hand, users benefit if more clubs join the platform as more cards become available (increasing supply). On the other hand, clubs benefit if more users join the platform as their brands are exposed to a wider audience and their revenue increases when more transactions happen (increasing demand).

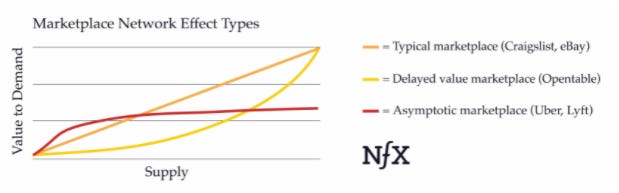

It’s worth noting that Sorare had to grow the supply-side of clubs to a relatively high level before there was real value for the demand-side, i.e., the users. To some extent, that means overcoming the chicken-egg problem: How do you get clubs interested in Sorare until users exist and vice versa? Now that Sorare seems to be on the verge of achieving this critical mass, the network effect becomes powerful. James Curier has illustrated that well with the example of Opentable.

Sorare is in a great position as they have created a flywheel that has allowed them to grow. To make things even better, there’s another flywheel to be integrated when we consider the Ethereum blockchain again. By opening up the API, Sorare allows everyone to build third-party applications by using Sorare’s data. This creates new use cases for Sorare cards, thereby increasing their general utility.

While this flywheel has allowed Sorare to grow, it also helps them to build defensibility and create an economic moat. Warren Buffet suggests that buying a business is like buying a castle surrounded by a deep moat that fends of all competitors. It can be defined as a company’s ability to build a barrier against new competitors and to protect its market share.

In this respect, Sorare is in a great position as it has created great entry barriers thanks to the official licenses from clubs. At the same time, the company also has untapped pricing power as they can raise the returns just by introducing a commission on the secondary market.

Admittedly, however, it is still too early to judge how strong Sorare’s moat really is. Coming back to Buffett’s analogy, if you have built a great castle other people will try to figure out how to get into that castle or build a similar one. Then the question becomes how permanent or how vulnerable your moat really is. While it’s too early to argue that Sorare has built a strong moat for the next 10 years, they are on a good way to do so.

Putting all things together, we can conclude that Sorare is in a great position. Despite the fact that the founders were not focused on short-term growth, Sorare has grown tremendously in recent months and clearly seen signs of product market fit. As Marc Andreessen describes product-market fit:” The customers are buying the product just as fast as you can make it—or usage is growing just as fast as you can add more servers.”

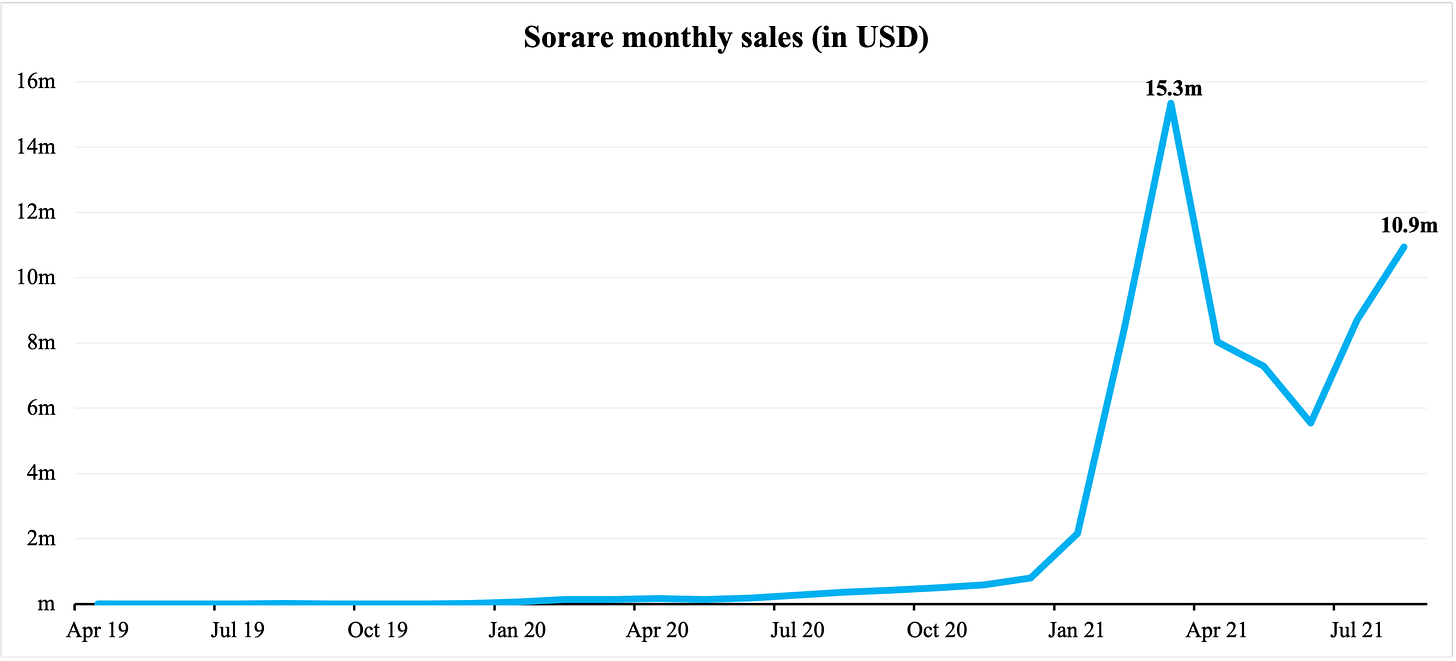

After its peak in March 2021 with more than $15m in sales, Sorare is on its way back to these levels. With the start of the new season, sales have already increased by more than 25% compared to July with six days to go in August.

If you look at more stats, you can see that the number of unique buyers (8,001) is almost on the same level as it was in March (8,773). The difference in sales volume comes from the decrease in average sales by $44.31. This is largely due to the introduction of the new category Limited, which entails lower prices.

What’s next?

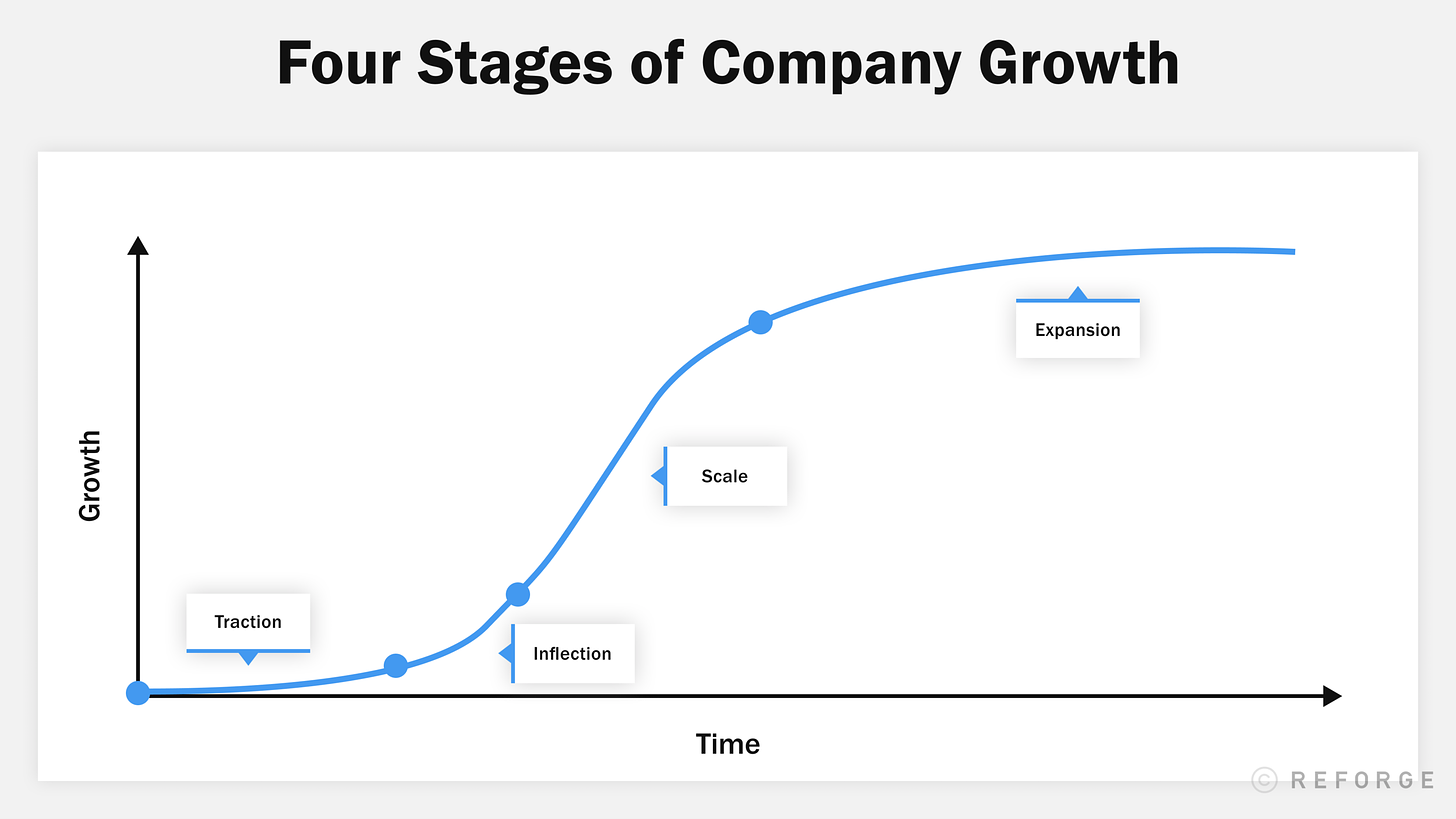

Sorare is currently transitioning into scalable growth loops. The new Ethereum blockchain enables scalability from a technical point of view while the introduction of a new product has increased the total addressable market. The continuous onboarding of more and more clubs enhances the market further while ensuring the creation of new cards.

There are couple of moves to leverage these requirements. In the following, I’m going to highlight some of them:

Gameplay, leagues and rewards

Marketing and expansion

Sorare ecosystem

Let’s dive into each one.

(1) Gameplay, leagues, and rewards

When it comes to the fantasy game itself, there are multiple ways to enhance the experience. On its simplest level, Sorare could create new cards and new tournaments with new rules and restrictions, for example a Legends Tournament, where only retired players can be used. Cards of coaches or stadiums as well as new challenges within the game make for further potential.

While Sorare is currently penetrating men’s football, it will be exciting to see when the women’s game will be onboarded. With Reddit co-founder Alexis Ohanian, Sorare has one of the loudest proponents of women’s football among its investors. He predicts that the trading card boom will be huge for women’s sports and is already working with Sorare to get it on the platform.

His optimism is based, among other things, on a McKinsey study that found that “an unprecedented amount of assets will shift into the hands of US women over the next three to five years, representing a $30 trillion opportunity by the end of the decade.” While many women will control the financial assets that baby boomers possess (since men die earlier), young women are also getting more financial savvy, taking over decision-making.

The growth of women’s sports in general cannot be denied either and has become one of the main topics at the very top of the football pyramid. Accelerating it is one of FIFA’s main goals until 2023.

Furthermore, there are multiple opportunities to increase the utility of cards that haven’t been unlocked. Right now, a card of Messi only allows you to benefit from his performances. But what if the card is also used as a ticket to the stadium? Or as a discount code to buy merchandise in the fanshop? In this way, NFTs could bridge the gap from the virtual to the physical world. This is also interesting from a club’s perspective if you think about the problems to attract younger generations into the stadium.

While Sorare’s retention rates are on a very high level right now, this number is likely to decrease once more users sign up for the platform. Some of these new use cases might be levers to increase the stickiness of customers.

(2) Marketing and expansion

“The third and most important way NFTs change creator economics is by making users owners, thereby reducing customer acquisition costs to near zero.” – Chris Dixon

Despite its success in recent months, Sorare has never done serious marketing aside from referral links and its affiliate program. As Chris Dixon points out, growth was driven by a passionate and excited community of card owners. This is one of the reasons why Sorare has been operating profitably since the beginning of 2020.

This community-driven growth, however, is only possible up to a certain point. Sorare has amassed a core of true believers but that’s not sufficient to become really big and enter into the mainstream. If it's up to Christian Miele of e.ventures, seed-investor in Sorare, the company has to “slowly become unprofitable now” in order to drive expansion. This brings us to one of the biggest challenges and most intriguing questions with many crypto games: What’s the probability of attracting customers outside of the crypto/gaming space?

There are good reasons to believe that Sorare is more than only a game for crypto enthusiasts. Football per se has more than three billion fans worldwide. Fantasy football as well as collectible cards are both mainstream and growing phenomena that appeal to millions of football fans.

Fantasy Premier League, for example, has nearly eight million users every season. What’s more, Allied Market Research predicts the global fantasy sports market to reach $48.6 billion by 2027. In addition to fantasy players, there will also be fans who focus on the collectibles – whether it’s because they used to collect Panini stickers back in the days or because they are simply interested in NFTs. In the US, football card sales grew by 1,586% last year.

Most importantly, Sorare does not aggregate these markets, it enhances them by allowing users to play fantasy games while owning their cards.

Current users are arguably either interested in the crypto and gaming space or early adaptor-football fans who are generally inclined to spend money on their favorite sports, for example through betting. The largest segment of more casual fantasy fans, however, is yet to be approached. That being said, this is about to change, and first steps have been made as shown by the sponsorship at Real Betis. Partnerships with companies could provide another lever to attract new customers.

What’s great about Sorare’s licensing deals with clubs is the audience that these clubs have. One post about Sorare by Real Madrid can arguably reach more people than Sorare ever could with its marketing activities. These clubs usually have a basis of trust with their fans and various ways of communication. This makes it easier to explain the idea to casual fans and increases the likelihood that they will try it out.

(3) Sorare’s ecosystem

While Sorare describes the creation of an ecosystem as its long-term goal, some building blocks are already in place like podcasts, blogs, and other third-party applications. All of this happened without any incentives aside from building on an open blockchain with an open API that everyone has access to. The core idea of an ecosystem is extensive interoperability so that things that you build in one place are portable to another place.

In Sorare’s vision of an ecosystem, there is also a media element involved. Currently, if you want to watch the performance or highlights of your players, you have to do that on other media channels such as Sky. At some point, however, this could be integrated into the NFTs. If you have a card of Kylian Mbappé, for example, you might be able to see clips of his goals in real-time.

Another essential part is the focus on community. It’s simply more fun to play a cool game while connecting with like-minded people and progress together. In the future, this could even be taken one step further. While community channels like Discord are a way to connect, entire virtual worlds like Decentraland could make for an entirely new experience. Facebooks “Horizon Workrooms” are another step in that direction and Zuckerberg’s plans of the metaverse.

“Now that digital ownership is exploding by way of NFTs, people are seeing bigger financial and status opportunities online than offline. This is the biggest catalyst for living online we’ve seen to date. Individuals are building status and identity in the virtual world the way that they do in the physical world. Why own a Gucci bag to impress a few hundred people in your town when you can own a digital one to impress millions?” – Jarrod Dicker

Final remarks

When Devin Finzer announced the $1 billion milestone in trading volume, he ended his post, arguing that “it's still day 0 for NFTs.”

I believe there’s a lot of truth in this statement. Many people (including me) are just starting to understand the opportunities that come with this next big computing wave of crypto and blockchains. There is still a lot of hype and speculation around it. At some point, the growth of NFTs will slow down, regress closer to the mean and many projects will die.

That said, there is a bunch of reasons why Sorare is in a great position to be one of those projects that become a leader in the space. Nicolas and Adrien have created a passionate and highly engaged community, signed licensing deals with clubs, and built everything on an Ethereum blockchain that allows them to scale into the mainstream.

Sorare has achieved this by being a first mover. Paul Graham argues that “in most businesses the advantage of being first to market are not overwhelmingly great.” There are many examples that underline this statement. Google’s ability to take over the search market is among the most popular ones. For Sorare, however, there’s a good argument to be made that the advantage of being first is, in fact, overwhelmingly great. Its licensing deals with clubs and leagues around the world have created a barrier that makes it very difficult for new companies to compete.

With new growth and thousands of new players on the platform, new challenges and questions will inevitably arise for Sorare. Some examples:

Can you maintain the same level of enthusiasm among users when there are suddenly 100,000 players instead of only 10,000 and it becomes much more difficult to earn rewards?

What influence could traders and speculators, perhaps even backed by wealthy investors, have? Could the market be distorted?

Can you keep high levels of engagement and retention among a larger user base?

To what extent is education needed in times where many people in the football world have formed a general skepticism due to bad experiences with Socios or player speculations on FootballIndex.

Perhaps the biggest challenge is finding the right balance between scaling and keeping a close relationship with the community. The community has been one of Sorare’s biggest strengths – if not the biggest. Sorare’s transparency and open communication has been reciprocated by many heavy users who spent considerable time in the game while also helping others to enter the game and spread the word. It can quickly happen that this gets out of sight once the community becomes bigger and bigger.

Nonetheless, none of this seems unsolvable and there are a lot more opportunities going forward – in the short- and the long-term. Sorare has created an exciting model which is just getting started to attract more and more football fans. In Devin Finzer’s words: “It’s still day 0 for Sorare.”

“At some point, Sorare will no longer be a digital card-based fantasy game but a unique digital football experience with real world impact! And now, dare to think about multiple other sports and segments that might benefit from such a thrilling change of scenery.” – Dominic Wilhelm