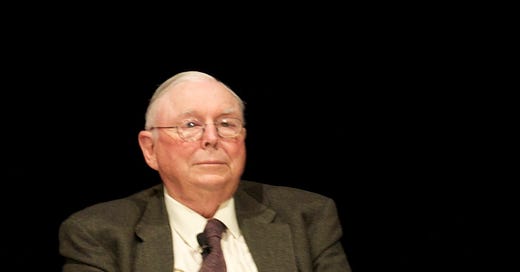

Charlie Munger FC -- Part 1

How would Charlie Munger lead a football club to glory? We'll find out by turning this question around, asking: How would Charlie Munger lead a football club to get relegated?

Charlie Munger is one of the most successful investors of all time. Much of his success as an investor was based on what he calls a latticework of mental models and clear principles. His principles, however, do not only apply to investing but everyday life and career. This poses the question: How would Charlie Munger lead a football club to glory?

When asked this question, Charlie might start with one of his most famous mental models: Inversion. Inversion says that when problems become challenging to solve, they may be more readily solved backward. In one of his speeches, he gave the example of helping India:

”If you want to help India, the question you should ask is not ‘How can I help India?’ It’s ‘what is doing the worst damage in India? What will automatically do the worst damage and how do I avoid it?‘“

Following Charlie’s advice, let’s use inversion, take some of his principles and start by asking:

How would Charlie Munger lead a football club to get relegated?

What could he do to avoid relegation? What would be the opposite of (1)?

Learn everything yourself

To get relegated, Charlie would prefer learning from his own personal experiences instead of learning from the experiences of others — living and dead, successful and unsuccessful. He would think: Why would you learn from a club that went bankrupt and relegated if you can make that experience yourself? In other words, the way to go is to become as non-educated and advice-resistant as you can.

Charlie would find himself mentors that have been in his position before. These mentors can either come in the form of books or personal relationships. He would also try to deeply understand how other clubs have been successful in the past, learn from them as much as he can and avoid easy mistakes. Something Johan Cruyff considered crucial for his success, too.

"I met the towering intellectuals in books, not in the classroom, which is natural... You’re hooked for lifetime learning, and without lifetime learning you people are not going to do very well."

Take every opportunity -- even if it's only the second-best

Another helpful ingredient for failure is taking advantage of any remotely attractive opportunity, even if it doesn't fit into the larger context or the club’s philosophy. Impatience is an important building block here. If Charlie wouldn’t get his preferred player, he would just buy the next-best he can somehow get.

Charlie is known to hold a lot of cash when he doesn't see good investment opportunities. He doesn't settle for the second- or third-best option but stays patient. And if he does settle for the second- or third-best option, he maintains flexibility in the long term. He waits for good opportunities and bets heavily when they eventually come up. To find such great opportunities it's important to look deeper, understand the underlying reasons for events or performances.

"You should remember that good ideas are rare -- you have to have the discipline to wait and when the odds are greatly in your favor, bet heavily"

Take everything for face value

Charlie repeatedly talks about pari-mutuel systems at a racetrack. Everybody goes there, bets, and the odds change based on what's bet. A transfer market is similar to some extent. Everyone sees and likes the great player who scored a bunch of goals last year. But this might have increased his price in such a way that it's not clear anymore if he really offers the best value for your money. To achieve misery, Charlie would ignore that and focus on whatever is hot right now.

Charlie would dig deeper and try to understand the underlying reasons. He looks for mispriced gambles. A player could be a mispriced gamble when his current performance is out of sync with his past performances as well as his long-term outlook. He would try to evaluate the reasons, thereby identifying mispricing on the upside (overvalued players) and on the downside (undervalued players).

"You're looking for a mispriced gamble. That's what investing is. And you have to know whether the gamble is mispriced. That's value investing."

Use Cookie-Cutter Solutions

To lead the club into the abyss, Charlie would ignore all the peculiarities of the club — the tradition, the culture. He would stubbornly enforce his approach, which he learned elsewhere and believes to be the best solution no matter the circumstances.

If Charlie would become manager at Schalke, he wouldn't build a club based on the Red Bull philosophy. All clubs are unique. He would do what he did with Berkshire: Whenever they bought a business, they left the existing culture intact and if changes had to be made, they would be made with a healthy respect for tradition.

"One solution fits all is not the way to go ... The right culture for the Mayo Clinic is different from the right culture at a Hollywood movie studio. You can't run all these places with a cookie-cutter solution."

View problems only from one perspective

Once Charlie has formed an opinion about a player, he would only look for evidence that confirms his opinion, ignoring anything that might contradict it. He would find excuses and interpretations why some disconfirming evidence may not be true. Confirmation bias at its best.

Charlie's thinking was very much influenced by Charles Darwin who paid particular attention to disconfirming evidence. Before buying or drafting a new player, Charlie would articulate the counter-arguments of this player better than the pro-arguments. He wouldn't allow himself to act before he was able to do so. If he learned that the counter-arguments are too strong, he would be willing to change his mind. He would introduce objectivity routines like checklists to avoid errors.

“It’s bad to have an opinion you’re proud of if you can’t state the arguments for the other side better than your opponents.”